A debt government program consolidates your entire credit card bills towards the that, lower payment per month on a lowered interest rate. You can be financial obligation totally free during the step 3-five years.

What is actually Debt consolidation reduction?

Debt consolidation integrates multiple bills on one commission that have good far more favorable interest and a lot more affordable payment.

You can find sort of debt consolidation reduction applications, additionally the goal of each is to reduce the pace on your own obligations and relieve the new payment to a level that you can repay in 3-five years.

- An individual payment per month – One to payment, to just one origin, once per month. Don’t worrying all about payment dates and you can lowest payment wide variety. Debt consolidation simplifies the bill-expenses process.

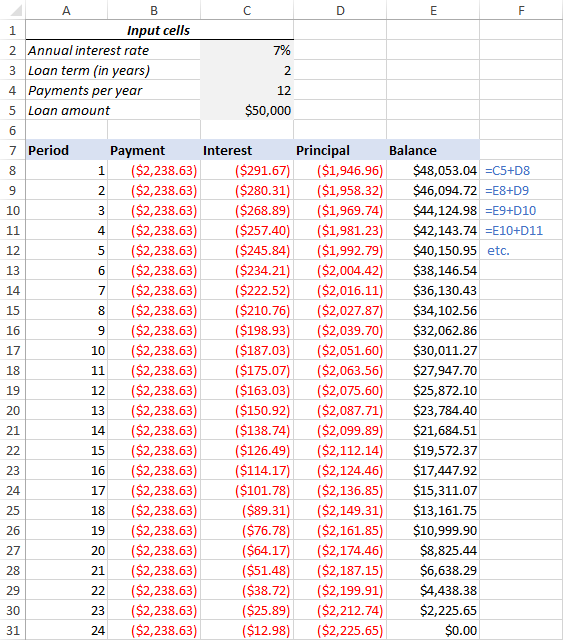

- Straight down interest rate– Charge card interest levels will add hundreds – either plenty – regarding dollars toward obligations. Lowering the interest wil dramatically reduce the amount of obligations you pay.

- Pay back expense reduced– Debt consolidating programs reduce the incentives for you personally to step 3-five years. Seeking pay off highest desire credit debt by making minimal monthly installments takes 10 years otherwise, normally, offered.

The standard style of merging obligations is always to take out that large financing regarding a bank, borrowing connection or on the web financial and employ it to repay multiple faster expense. It can be active, unless you possess a  decreased credit score, then you is almost certainly not acknowledged having a loans integration financing, and/or mortgage carries eg a high interest it try off no benefit.

decreased credit score, then you is almost certainly not acknowledged having a loans integration financing, and/or mortgage carries eg a high interest it try off no benefit.

If the a minimal credit score is the reason you were became off getting a debt settlement financing, following think a personal debt government package, a simple – and very effective – cure for combine loans.

A financial obligation management package has got the exact same pros while the a financial obligation integration mortgage – faster rate of interest minimizing payment – however, with no stress out-of taking on a loan. Plus, your credit rating is not one thing to own enrolling.

Loans government are an idea given by nonprofit credit counseling firms, such as for instance InCharge Personal debt Options which can consolidate their credit card debt into the one monthly payment while the interest falls to somewhere as much as 8%.

Ideas on how to Consolidate Personal debt

Very first, you should decide on how you can combine your debt. As stated a lot more than, costs should be consolidated that have otherwise as opposed to a loan.

Or even be eligible for a debt negotiation loan otherwise try not to keeps a leading enough credit history to acquire a low interest price loan, your best choice is a personal debt administration bundle provided by nonprofit borrowing from the bank counseling companies.

Combining Debt rather than that loan

- Focus on a phone call to help you good nonprofit service such InCharge Obligations Possibilities and found a free credit counseling session.

- A cards counselor have a tendency to feedback your financial allowance, get to know the debt and you will strongly recommend your debt-rescue service that’s perfect for your position.

- In the event your earnings is enough to cover basic bills and you can generate monthly premiums, there is the choice to subscribe an obligations management program.

- Nonprofit borrowing guidance organizations enjoys arrangements in position which have bank card enterprises so you’re able to substantially remove rates and relax fees through its financial obligation administration apps (Note: That isn’t a discussion to help you “settle your debts” – an answer used by to have-profit credit card debt relief companies).

- Immediately after enlisted, personal debt administration applications are designed to speed up your payments in order to borrowing credit companies and pay off your debts inside the 3-5 years.

Consolidating Financial obligation that have financing

- Make a listing of the fresh new expense you want to consolidate.